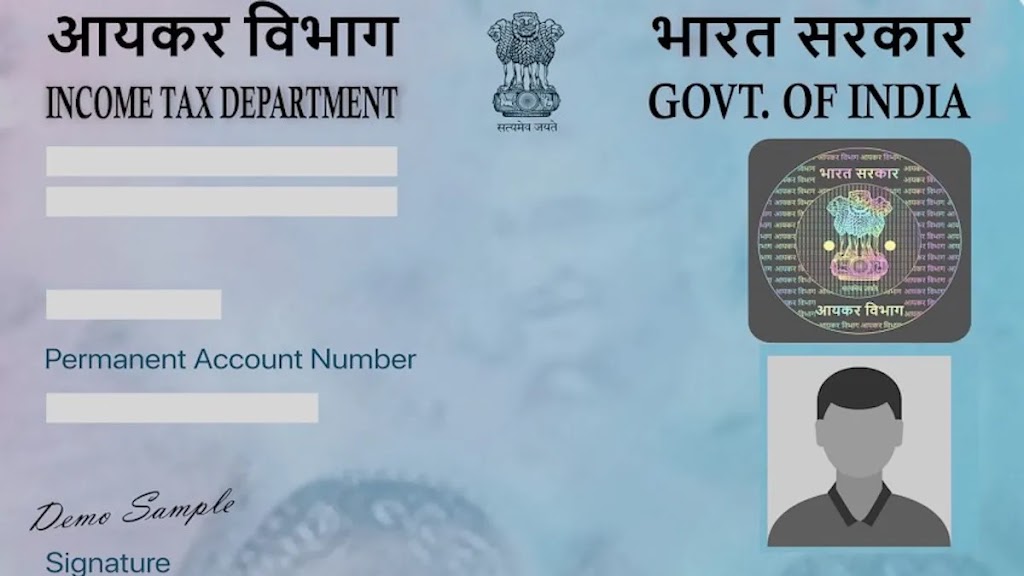

The introduction of PAN Card 2.0 comes with several enhancements designed to improve both functionality and user experience. The new version of the Permanent Account Number (PAN) card aims to streamline the process and make it more efficient for users. Here are some of the key benefits:

-

Enhanced Security Features: PAN Card 2.0 is equipped with more advanced security features, including a QR code that can be scanned for quick validation. This reduces the risk of misuse and fraud, ensuring that the card is authentic.

-

Easy Access and Retrieval: With a digital version of PAN Card 2.0 available through the Income Tax Department’s website and mobile app, individuals can easily access and download their PAN details. This eliminates the need for physical cards and makes it more accessible for taxpayers.

-

Simplified and Paperless Process: The new PAN Card 2.0 simplifies the application process, making it more streamlined and paperless. Applicants can now easily apply for PAN cards online and track the status of their application, reducing time and effort.

-

Linkage to Aadhaar: PAN Card 2.0 is designed to be seamlessly linked with Aadhaar, improving the process of verification and making it easier for individuals to authenticate their identity for various financial and government services.

-

Quicker Transactions: With its updated security and technology, PAN Card 2.0 allows for quicker and more secure financial transactions. This is particularly useful for individuals and businesses engaging in online banking, investments, and tax-related matters.

-

Increased Transparency: By integrating the new PAN with other identity databases and government systems, there is better tracking of individuals’ financial activities, leading to increased transparency in taxation and reduced tax evasion.

-

Global Recognition: The revamped PAN Card 2.0 is also expected to be more globally recognized, making it easier for Indian residents and non-residents to participate in international transactions, investments, and business activities.

In summary, PAN Card 2.0 offers several improvements over the older version, providing a more secure, efficient, and user-friendly experience for both individuals and businesses. It plays a crucial role in the digitalization of financial systems and the government’s push towards increased transparency in taxation.